By Jennifer Chong, Associate Director, Tax Solutions and Services

In today’s rapidly evolving business environment, transfer pricing (TP) remains one of the most closely scrutinised areas of tax compliance. The lnland Revenue Authority of Singapore (IRAS) increasingly expects companies to go beyond mere form filing.

IRAS emphasises the importance of related-party transactions being conducted at arm’s length, ensuring that profits and recharges are reported where economic value is created. Businesses can no longer rely solely on a compliant TP report; they must have policies that accurately reflect operations and clearly demonstrate alignment between pricing and underlying economic substance.

Why TP matters

The business impact is clear – non-compliance with TP rules can result in tax adjustments, penalties and prolonged audits. Conversely, robust TP documentation serves as your primary audit defence and demonstrates governance transparency to tax authorities.

Singapore’s TP regime aligns with Organisation for Economic Co-operation and Development (OECD) standards while reflecting local rules. At its core is the arm’s length principle: transactions between related parties must be priced as if they were conducted between independent parties under similar circumstances. This fundamental requirement ensures that Singapore’s tax base is protected and that profits are reported where genuine economic value is created.

The principle applies to a wide range of transactions, including intercompany sales, loans, services, leases and guarantees. If your business or family office deals with related parties, such as overseas subsidiaries, holding companies, or entities owned by family members, you must comply with TP rules.

To demonstrate arm’s length pricing, companies often perform benchmarking studies, which involve identifying similar transactions between independent companies, pricing them and selecting the most appropriate TP method. Benchmarking helps demonstrate that the agreed price is fair and defensible if reviewed by the tax authorities.

Transfer pricing documentation (TPD)

Businesses must prepare contemporaneous documentation for related party transactions in compliance with the arm’s length principle regardless of the transaction value, while also supporting overall business objectives.

This documentation provides IRAS with clear and reliable information to assess whether your TP practices are reasonable and to identify any potential TP risk efficiently.

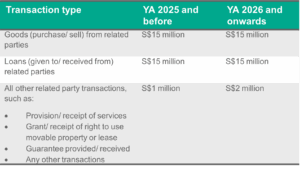

TPD is mandatory if:

TPD covers the following:

TPD deadline

TPD submission

TPD exemptions

Turning compliance into strategic advantage

TP is not merely about documentation; it is about managing risk and demonstrating transparency. IRAS continues to tighten enforcement and businesses that assume they fall under exemptions may still face pricing reviews.

A proactive TP framework (policy and documentation) is essential and supports:

- Avoiding TP adjustments and penalties

- Demonstrating robust governance and transparency to tax authorities

- Supporting sustainable business growth while minimising disputes

As businesses expand into new markets or review their related party arrangements, having a robust TP policy and benchmarking strategy becomes essential – not just for compliance, but for competitive advantage.

How we can help

Our IQ-EQ expert tax team in Singapore can strengthen your TP documentation and help you gain business advantage from compliance. Whether you’re implementing TP policy, preparing TPD, or conducting benchmarking studies, we provide tailored guidance and implementation support.

Ready to transform your transfer pricing approach? Reach out to your IQ-EQ representative or get in touch for more information.