Precision and efficiency are non-negotiable in the asset management industry, making a good fund administrator an absolute necessity. These firms handle everything from investor onboarding to fund accounting and regulatory compliance, so they can be a major contributor to an asset manager’s overall success.

Often, however, the relationship between an asset manager and its fund administrator isn’t a perfect fit. Over time, evolving needs – particularly in relation to technology and service quality – can lead to a reduced level of customer satisfaction and the desire to find a new partner.

In this post, we highlight five reasons many asset managers are considering a fund administrator switch today, offering insights into the critical factors that can drive this important decision.

1. The need for advanced technology

For many asset managers, the need for cutting-edge technology is a major catalyst for switching fund administrators. In this day and age, firms require sophisticated (and seamlessly integrated) technology that can handle global onboarding, multi-asset-class reporting, data ingestion and reporting including predictive analytics, and complex regulatory requirements – capabilities not offered by all service providers.

Increasingly, asset managers are turning to providers that are utilising cloud-based platforms and harnessing the power of technologies such as artificial intelligence (AI), natural language processing (NLP), and automation. These capabilities enable firms to gain deeper insights from their data, offer more tailored client interactions, and scale operations efficiently.

2. Too many fragmented systems

As asset managers grow across borders, they tend to run into challenges. Frequently, firms find themselves working with a fragmented network of providers handling various services across multiple jurisdictions, which is inefficient. This can result in complex operations, wasted effort through duplication, and high overall costs. It also means that sensitive data is held by a number of organisations, increasing the risk of a data breach.

Eventually, there comes a point where it’s sensible to partner with a global provider that offers a sophisticated unified platform. Consolidating services under a single global service provider that offers cross-jurisdictional access can streamline processes, mitigate risk, and help to improve relationships with clients.

3. Not enough focus on relationships

Asset management thrives on human interaction. At its core, it’s an industry built on relationships. However, not every fund services provider thinks the same way about human capital. In the fund administration world, high levels of employee turnover are common, meaning that asset managers frequently have to build new relationships from scratch. Ideally, asset managers want to partner with a fund provider that attracts, develops, and retains the best talent, provides its clients with dedicated teams, offers director-led relationship management with frequent touchpoints, and proactively solicits and shares client feedback.

At IQ-EQ, we know it’s our people who are the key to delivering exceptional client service. We therefore strive to create an environment in which our people can thrive and deliver their best. We articulate and manifest this commitment through our Employee Value Proposition (EVP), which aims to ensure our people are empowered to be themselves, given opportunities to grow, and recognised for a job well done. Since we launched our EVP in early 2023, it’s helped to reduce employee turnover significantly – our global voluntary turnover rate decreased 26% year on year.

4. The need for specific expertise

The asset management industry has undergone an enormous amount of change over the last decade. For a start, demand for alternative investments has grown exponentially. This has led managers to develop new products such as hybrid funds, which are designed to offer greater diversity in terms of asset classes, return profiles and liquidity structures.

Additionally, we’re seeing the ‘retailisation’ of the private markets. New regulatory frameworks such as the European Long-Term Investment Fund (ELTIF) 2.0 and the UK’s Long-Term Asset Fund (LTAF) are enabling greater retail investor interest in private equity and private debt. Looking ahead, this trend is expected to continue.

What this all means is that asset managers require a fund administrator with deep expertise across the alternatives space that is capable of simplifying activities such as reporting, performance tracking, and compliance management. Firms also need platforms offering seamless digital experiences (particularly in relation to investor onboarding), real-time reporting and data capabilities, automation and data security.

5. A lack of customer satisfaction

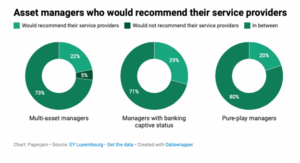

Finally, there’s the issue of client satisfaction. In the fund administration industry, this is often low. According to EY Luxembourg, only one in five asset managers would actually recommend their asset servicers. Low digital capabilities and the quality of the customer experience are the two biggest factors cited by firms as reasons for the lack of confidence in their service providers.

It’s worth pointing out that IQ-EQ’s Net Promoter Score (NPS) has averaged over 73 for the last four years – well above our target of 70. NPS is a widely used metric that measures customer loyalty by gauging customers’ willingness to recommend a company, product or service to others. One thing that has potentially helped us achieve such a strong NPS is our regular discussions with clients. Connecting with our clients on a deeper level is a priority for us and, to date, we’ve spoken to more than 490 clients and business partners about their challenges. This has enabled us to better understand – and address – their needs and concerns.

Unlock your full potential with IQ-EQ’s Switch Package

To remain competitive today, asset managers require a partner that can provide consolidated, digitally advanced and globally capable solutions. With the right partner, firms can keep pace with change and thrive in the modern financial ecosystem.