Private trust companies (PTCs) are powerful tools for maximizing family wealth, streamlining governance and optimizing succession planning. We recently authored a guide including detailed information about PTCs on a global scale (download that guide for free here), but choosing a U.S. situs carries enough unique considerations to merit a separate discussion.

What is a PTC?

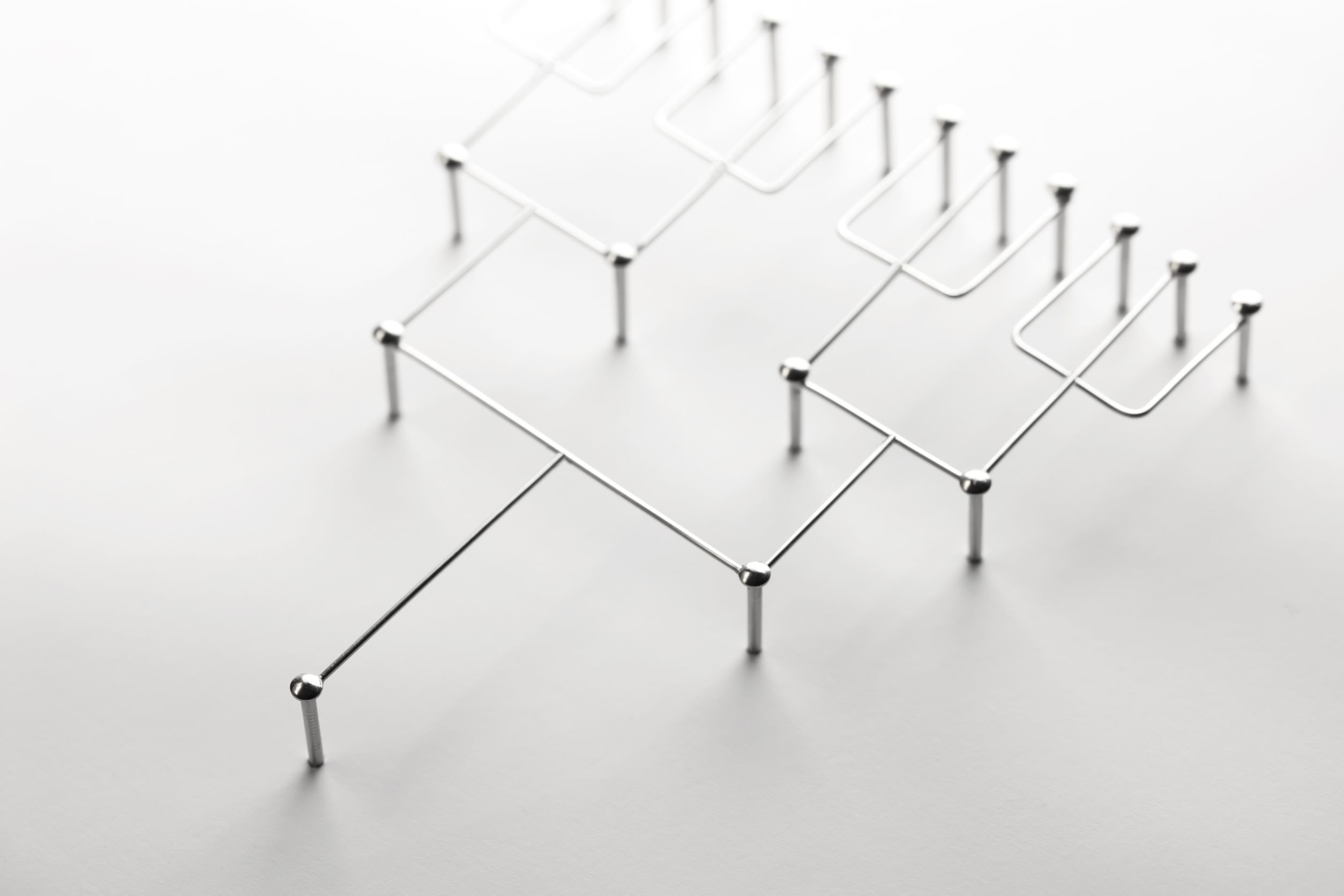

A private trust company (PTC) is an organization that acts as trustee of one or more trusts established for a single family, including branches. As its name implies, a PTC is privately owned and run, and therefore does not provide trustee services to the public.

Using a PTC as trustee enables family members to be directly involved in decision-making processes, either by sitting on the board of the PTC or on advisory committees. As such, a PTC becomes more than a bespoke trustee service; it can also serve as a family governance tool and legal structure.

In practice, PTCs are usually administered by professional trustees to ensure compliance and help navigate family disputes. The shares of a PTC are usually owned by a dedicated purpose trust (rather than through direct family ownership), as the goals are most often continuity of ownership of the trustee and a degree of confidentiality.

Why are PTCs so popular in the U.S.?

PTCs are gaining popularity against the traditional trustee model because they:

- Give families more control over their fiduciary structures

- Limit liability for family members and trusted advisers

- Allow families to hold concentrated positions or non-traditional assets

- Enable access to favorable state tax and trust laws

- Help with efficient decision-making and implementation

- Separate tasks and allocate them to people with the requisite expertise

- Decrease trustee costs

For ultra-high-net-worth (UHNW) families looking to realize the asset protection and intergenerational wealth transfer benefits that trusts provide, PTCs are often an ideal structure to hold and oversee a family office. They often seek an ownership structure that offers more control over investment and distribution decisions—and more flexibility over asset and governance structures—than traditional trusts provide.

The trusts administered within the PTC are the owners of the assets transferred to them. The settlors who fund the trusts are no longer the asset owners, nor are the beneficiaries. Instead, the trusts are administered for the benefit of beneficiaries. This separation of ownership allows PTCs to provide asset protection and estate tax planning benefits.

Limited family partnerships and limited liability companies owned outright by family members (rather than through trusts) are other common structuring approaches. However, direct ownership does not provide the benefits of trust ownership granted by PTCs for asset protection and estate planning because LP and LLC interests remain on their members’ personal balance sheets.

What are the best U.S. jurisdictions to structure a PTC?

In the U.S., several modern trust law jurisdictions have become popular:

- New Hampshire

- South Dakota

- Wyoming

- Delaware

- Nevada

- Tennessee

- Alaska

For many families, New Hampshire is a particularly preferred jurisdiction because it allows for both regulated and unregulated PTCs and is close to major financial centers within the United States. Because single family offices are overseeing a single family’s assets, many families view the overhead and extra effort required of regulated PTCs as unnecessary.