Selecting an aircraft registry as a business jet owner can be a daunting process. Today, there are more than 200 registries worldwide and choosing the right jurisdiction requires consideration of a range of variables.

In this feature, we will highlight some of the most important factors for business jet owners to consider when choosing a registry. We will also provide a brief overview of some of the major business aviation-focused registries to help aircraft owners narrow down their choices.

Why registry location matters

Aircraft registries play a vital role in the aviation industry, ensuring the safe and legal operation of aircraft worldwide. But there can be vast differences between registries.

The registry’s jurisdiction will determine the regulatory framework the aircraft owner is subject to and govern aspects such as maintenance requirements, operational restrictions, and taxes. So, choosing a registry is not merely a formality; it has far-reaching ramifications. It’s therefore crucial to make a sound choice when picking a registry.

Important factors to consider

When choosing an aircraft registry, there are many things to consider. Some of the most important factors include:

- Safety standards – Safety should always be at the top of the list when selecting an aircraft registry. Owners should go for a registry that ensures that aircraft undergo regular safety inspections and are operated to International Civil Aviation Organisation (ICAO) standards. ICAO’s standards and recommended practices (SARPs) help to ensure that aircraft from all over the world can operate safely together

- Legislation and regulation – It’s important to select a jurisdiction that provides effective oversight and enforcement. Banks and lending institutions will want a jurisdiction with a robust legal system that facilitates the registration of security interests and the enforcement and recovery of financed aircraft in the event of a default. Be aware of any regulation that could be prohibitive, however, such as operating restrictions

- Costs – There are notable variances in the charging structures between registries with some opting for ‘all-inclusive’ models and others operating on a time/per certificate basis. So, this should be considered. Owners should also consider the availability of maintenance and support services in the jurisdiction. Having access to reliable maintenance services can mitigate costs for owners

- Taxes – Different jurisdictions can have varying tax laws when it comes to aircraft ownership meaning that the jurisdiction you select can have implications for Capital Gains Tax (CGT), Capital Transfer Tax (CTT), Inheritance Tax (IHT), Value Added Tax (VAT), and Goods & Services Tax (GST), particularly where aircraft are chartered, leased or sold for commercial gain. Some jurisdictions offer favourable tax benefits, which can result in significant cost savings

- Service levels – Service levels can have an impact on turnaround times so they shouldn’t be ignored. Choosing a registry that offers excellent service – and makes day-to-day operations efficient – can enhance the overall experience as an aircraft owner. It’s worth noting that the time zone of the registry can play a role here as this can impact your ability to speak to members of the registry team. If privacy is important to you, consider registering your aircraft in a jurisdiction that offers strong privacy protection. Similarly, if having a personalised registration suffix is important, seek out a registry that offers this

- Reputation – The reputation of an aircraft registry is important. If a jurisdiction is known for having a robust regulatory framework and a track record of effective oversight, it inspires trust and confidence. A strong reputation can also have a positive impact on the resale value of your aircraft as it will provide a certain level of assurance to prospective buyers that the aircraft has been properly maintained in the past

It’s worth pointing out that when comparing registries, it’s important to give some thought to your aircraft’s intended purpose. Variables such as the primary operating location, intended routes, and ownership structure should be considered. Once you know these, you can identify the most suitable registry for your requirements.

Comparing major aircraft registries

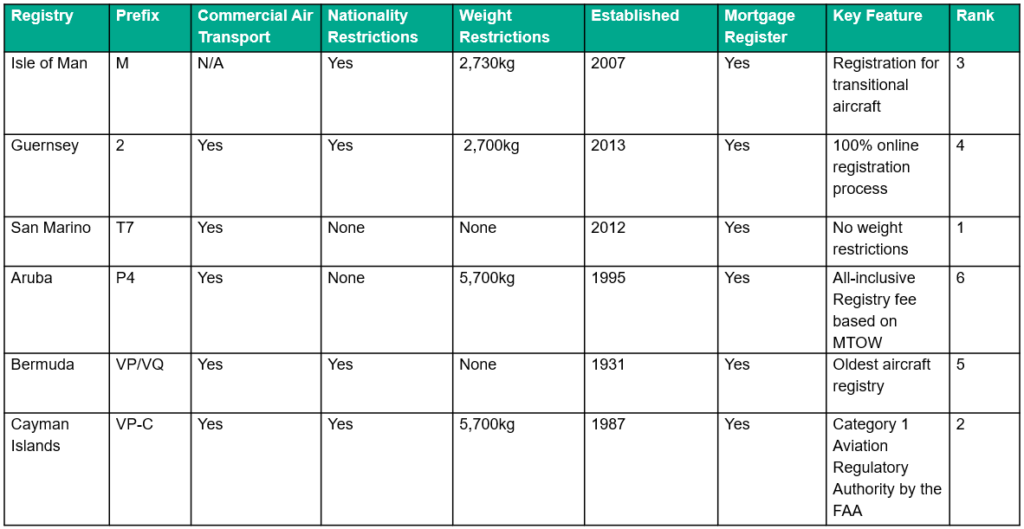

Some of the more popular registries for businesses include the Isle of Man, Guernsey, San Marino, Aruba, Bermuda, and the Cayman Islands. The table below compares these registries and highlights their key features.

One that’s worth highlighting here is Isle of Man (IOM). Established in 2007, it is the leading registry in the European time zone.

The IOM Aircraft Registry offers high regulatory standards, excellent customer service, competitive charges, and a secure mortgage register – all underpinned by the island’s political stability and robust legal framework. It also offers an attractive tax regime with a standard corporate rate of 0-10% – some of the lowest tax rates in Europe.

Additionally, it benefits from a strong professional network on-island to support the aviation sector, including banks, aircraft operators, lawyers, and trust and corporate services providers. As a result of these attributes, it was voted Best Global Aviation Registry in the World Commerce Review Awards in both 2019 and 2020.

How IQ-EQ can help

In conclusion, choosing an aircraft registry requires careful consideration of a range of factors including registry reputation, safety standards, service levels, fees and taxes. It’s not a decision that should be taken lightly as it can have a major impact on your overall ownership experience.

Given the complexity of the process, it’s sensible to seek guidance from an expert. They will be able to help you navigate the nuances of registry selection, ensuring you make an informed decision that is aligned with your specific requirements.

At IQ-EQ, we help business jet owners register, and structure the ownership of their aircraft. To learn more about our aircraft services, please get in touch.

This article was originally published in The Official Guide to Aircraft Registration 2024 by Corporate Jet Investor.