On 15 March 2023, the UK Government announced its Annual Spring Budget with tax policy updates and the headline points included a most relevant item for the funds industry: carried interest.

In this article, we take a deeper dive into this significant announcement and summarise what the change means for fund managers and investors – the bottom line being that the tax policy change is good news for the people who receive carried interest.

As the policy document states, “UK resident individuals who pay tax on carried interest are sometimes unable to claim double taxation relief from other countries because carried interest is recognised and charged to tax at a different time in the two jurisdictions”.

Let’s reflect on each aspect of this statement to understand how this measure helps such individuals avoid the onerous and unfair burden of double taxation:

What is carried interest?

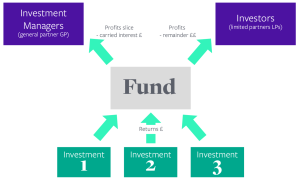

Carried interest is written into most funds’ legal agreements (LPAs), and apportions a slice of a fund’s profits* to the general partner of the fund.

Most profits go to the investors (LPs) because they inject the majority of the capital for the fund to invest; LPs receive their profits on a sliding priority basis before the GP, which is calculated via a carry model.

The slice that goes to the GP is to compensate the investment managers and founders of the fund for setting it up and managing profitable investments and generally doing a good job.

*A cautionary note on the usage of the term ‘profit’ – here it means surplus returns above fund contributions, which is not the same as accounting gross or net profit.

How is carried interest taxed?

As we know, funds themselves are almost fully exempt from tax across the board, so zero corporation tax applies in most jurisdictions, but some VAT and small local taxes sometimes apply.

When the GP receives carry, it allocates such surplus to the founders and investment managers, and when income reaches those individuals, that’s where it gets taxed.

There is a long running argument about how the income should be taxed:

Like wages and salaries – subject to income tax; the top band in the UK is 45% on earnings over £150,000

As a chargeable gain – subject to capital gains tax, which in the UK is 20%

In most countries the above tax disparity is similar to the UK and the rules all generally lean towards allowing carry to be taxed as a chargeable gain. This makes sense because carry is not guaranteed unless there are profits, thus it is best treated like irregular entrepreneurial gains. Fund managers and fund founders will obviously always fight for that to remain, since the tax burden is much lower.

What’s the problem with tax and carry?

- Double tax – An individual who is subject to tax in multiple jurisdictions can end up paying tax on the same worldwide income more than once. That’s manifestly unfair so most countries have agreements with each other to alleviate this, and these agreements are called double tax treaties. In the case of the UK, for instance, there are treaties in place with more than 100 countries.

For example, if you work out your UK tax charge on some dividends to be £200, but you already paid £150 of tax on the same income in the US, you can deduct the £150 as double tax relief from your £200 bill and only pay the UK government the other £50. - Timing – With carried interest in particular, the point at which a chargeable gain arises is subject to debate – in some countries it is when an individual is allocated a share of carry even if that carry is unrealised (i.e. the assets in the fund that have gone up in value and triggered carried interest haven’t yet been sold); in other countries it is when the value crystallises and cash changes hands.

To apply double tax relief, your chargeable gain has to fall into the same time window (taxable year), but due to point 2 above, that doesn’t always happen and carry recipients can end up paying tax more than once on the same carried interest income.

What are the implications of the new policy?

The change ushered in on Wednesday 15 March allows a UK taxable person to choose to declare the chargeable gain earlier in order to align tax liabilities and ensure that double tax relief can be applied.

It also allows this change to be applied with retrospective effect, from April last year, which is helpful.

The relevant excerpt is provided below:

“1.10 Introducing an elective accrual basis for the carried interest rules

“As announced at Spring Budget 2023, the government will legislate in Spring Finance Bill 2023 to provide a new elective accrual basis of treatment for carried interest. This will allow UK resident investment managers to accelerate their tax liabilities in order to align their timing with the position in other jurisdictions, where they may obtain double taxation relief. The measure will apply from 6 April 2022.

“The tax information and impact note for this measure provides more information:

Introducing an elective accrual basis for the carried interest rules.”

We note that the ‘accelerate their tax liabilities’ phrase sounds like ‘paying tax earlier’ but it actually translates into the individual now being able to choose an earlier timing simply to avoid paying multiple taxes on the same income – so it’s good news! Indeed, as the policy document reads at the outset, “this measure will allow UK resident investment managers to make an election to accelerate their tax liabilities in order to align their timing with the position in other jurisdictions, where they may obtain double taxation relief.”

How IQ-EQ can help?

At IQ-EQ, our Investor Solutions Accounting team can help with carry modelling and verification checks on behalf of our clients. Please reach out to our experts to understand how IQ-EQ can best support you in light of this new announcement on carried interest.