In Mauritius, there is much discussion around the imminent end of the grandfathering period on 30 June 2021 and the importance of ensuring clients are ready for the conversion of their Category 1 Global Business Licence (GBC1) into a Global Business Licence (GBL) on 1 July 2021.

What’s the conversion all about?

GBC1 companies that obtained their licences prior to 16 October 2017 are grandfathered and will be converted into GBL companies on 1 July 2021. These companies need to ensure that they meet the substance requirements of the GBL prior to their conversion.

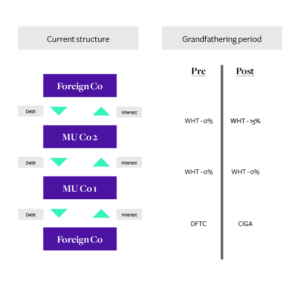

Mauritius has also undergone major tax reforms to comply with the international standards of the OECD and the EU. The previous tax regime, whereby only GBC1 companies benefitted from the Deemed Foreign Tax Credit (DFTC) of 80% on all of their foreign source income, was considered a harmful tax practice and will be abolished. Effective from 1 January 2019, Mauritius has instead introduced an 80% partial exemption regime on specified income streams. The partial exemption is only available if, amongst other things, a company carries its Core Income Generating Activities (CIGA) in Mauritius and meets the required substance as prescribed in respect of these income streams. The partial exemption will apply to the grandfathered companies from 1 July 2021.

Whilst many of us are focusing on the substance requirements to ensure our clients’ transition into GBL happens smoothly while mitigating any future challenges from the Mauritius Revenue Authority (MRA), we must be careful not to overlook a potential tax leakage that can be triggered on back-to-back debt financing involving double-tier structures in Mauritius post the grandfathering period.

How does the tax leakage happen?

GBL companies are commonly used in debt financing structures under which interests are paid to lenders at arm’s length. Interest payments made by GBL companies out of their foreign source income will continue to be exempt from withholding tax in Mauritius. Foreign source income historically included income between GBL companies. However, for grandfathered companies, as from 1 July 2021, foreign source income will no longer include income from another GBL company. Foreign source income will simply mean income that is not derived from Mauritius.

Post 30 June 2021, for double-tier structures (henceforth where a GBL company receives interest or any other income from another GBL company and uses this income to pay interest to its foreign parent company providing the loan), the interest payment will no longer be exempt from withholding tax in Mauritius. Withholding tax of 15% under the Mauritius domestic law will apply and the rate may be reduced under a double taxation agreement. The GBL company will need to remit the withholding tax to the MRA within one month of the interest being paid.

The illustration below shows the potential tax leakage:

To find out more about how IQ-EQ Mauritius and Taxand could support in reviewing your existing group structures and migitate any potential tax leakage, please don’t hesitate to contact me:

E: Feroz.Hematally@iqeq.com

T: +230 213 9936