With the imminent end of the grandfathering period on 30 June 2021 in Mauritius, Category 1 Global Business Licence (GBC1) companies will be automatically converted into Global Business Licence (GBL) companies on 1 July 2021.

One of the requirements to maintain the GBL is to carry out any core income generating activities (CIGA) in Mauritius. Added to this, the 80% Deemed Foreign Tax Credit (DFTC) will no longer be available. Instead, an 80% Partial Exemption Regime (PER) has been introduced on income, such as dividends and interest, and this only applies if the associated CIGA are carried out in Mauritius. The partial exemption will apply to all grandfathered companies from 1 July 2021.

Open-ended funds and self-managed funds

In the context of open-ended and self-managed funds, the requirement to have all CIGA in Mauritius can be challenging, given that the investment advisor usually sits overseas. The Mauritius Financial Services Commission (FSC) is conducting regular assessments and site visits to ensure that companies are indeed meeting the required criteria in order to maintain the GBL. Failing to comply with GBL requirements has financial consequences.

From a tax perspective, the Mauritius Revenue Authority (MRA) will deny a company the 80% partial exemption when it is not satisfied that the company is meeting the required substance or carrying its CIGA in Mauritius. Moreover, the number of tax returns investigated by the MRA has significantly increased over the years, making it even more vital that, when a company is claiming its partial exemption, it is indeed carrying out its CIGA in Mauritius.

Outsourcing of CIGA

The Statement of Practice issued by the MRA permits companies to outsource their CIGA as long as those activities are carried out in Mauritius.

How can IQ-EQ assist?

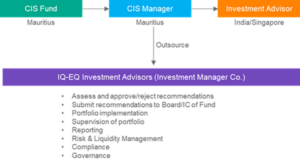

In Mauritius, IQ-EQ Investment Advisors Ltd (IQ-EQ Advisors) offers qualified professionals experienced in investments, trade executions and risk management. The business holds a CIS Manager Licence and an Investment Advisor Licence from the FSC.

The illustration below shows how, in the case of a collective investment scheme (CIS) or self-managed fund, the CIS manager in Mauritius can outsource the CIGA to IQ-EQ Advisors. From a substance perspective, it is also important to demonstrate that investment decisions and executions are carried out in Mauritius. Hence, outsourcing the investment advisory function to IQ-EQ Advisors will certainly enhance substance in Mauritius.