By Anne-Cathrine Frogg, Managing Director (Business Development), Mont-Fort Funds AG

Switzerland continues to be an attractive market for asset raising. Its investor market is broadly diversified across numerous private and international banks, independent asset managers, family offices of varying sizes, pension funds, large companies, and, of course, high-net-worth individuals (HNWI). In Deloitte’s recently released International Wealth Management Centre Ranking, Switzerland tops the list as the largest booking centre for international wealth management, valued at US$2.2 trillion, and leads in terms of competitiveness.

The highly sophisticated investor market has long understood and heavily invested in alternative investment strategies, including hedge funds, private equity, venture, real assets and, more recently, private credit. When managers are deciding on a European marketing strategy, Switzerland and/or the UK, as well as several EU countries, tend to be focus jurisdictions.

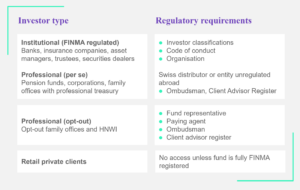

Switzerland’s regulatory framework is very open by European standards and allows all fund structures (including non-EU and those located offshore) access to its attractive pool of investors. However, knowledge of the regulatory requirements is necessary and requirements vary according to the investor type targeted.

Understanding Swiss regulatory requirements

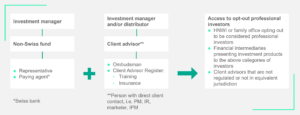

Depending on the marketing strategy pursued, requirements may apply to the fund, the investment manager and/or the distributor or placement agent.

Under the Swiss Financial Services Act (FinSA), part of the regulatory framework concerning fund distribution, it should be determined if, and by which party, a financial service (such as fund distribution) is being performed at the end-investor stage.

The applicable requirements for the product will be determined by the type of end investors targeted:

If opt-out professional investors, such as HNWI and certain family office structures, are within the scope of prospective investors, the fund must have appointed both a representative and a paying agent. The investment manager and/or placement agent also needs to ensure that the person(s) reaching out to prospective investors are on the Swiss Client Advisor Register. The below graph illustrates these requirements:

Case studies

Below are a few real-world examples to help assess specific requirements:

London-based private equity manager with in-house marketer as well as placement agent (all FCA regulated) targeting family offices of varying sizes (including family-managed) as well as opting-out HNWI

New York-based long-short equity manager (SEC regulated) marketing two funds via UK-based placement agent (FCA regulated) to Swiss private banks

Singapore-based manager (MAS regulated) distributing Cayman global macro fund into Switzerland, with uncertainty as to which investors will be targeted as they are working with cap-intro as well as relying on referrals from industry colleagues

There is no direct registration with the Swiss Financial Market Supervisory Authority (FINMA) necessary when distributing exclusively to qualified investors in Switzerland (i.e. when no retail investors are targeted). The process of appointing a representative and agent can be quick, and a knowledgeable partner can provide you with an efficient service.

Speak to Mont-Fort

Mont-Fort is a leader in the Swiss fund representation market, operating for over 10 years, with a high-quality global client base of approximately 200 alternative managers representing over 600 funds across private equity, private credit, venture, real assets and hedge funds.

Our team of experienced alternative investment specialists can provide fundraising advice and support, regulatory guidance and local contacts, as required. Should you have any questions regarding your approach to distributing your fund in Switzerland, Mont-Fort Funds AG can help you determine what is needed. Please get in touch to find out more.