By Vishal Lohia, Associate Partner, Dhruva Advisors LLP, and Khushboo Chopra, Head of Business Development, India, IQ-EQ

The International Financial Services Centre (IFSC) at GIFT City in India offers a multitude of investment avenues for non-resident Indians (NRIs) and overseas citizens of India (OCIs) looking to tap into the Indian capital markets.

This article will focus on the opportunities available via the International Financial Services Centres Authority (IFSCA)’s Fund Management Regulations (FMR), a robust regulatory framework for fund management activities. The FMR incorporates best practices from developed jurisdictions and aims to attract foreign investments by simplifying operational processes, making it an attractive option for NRIs seeking to invest in India.

Key features of the regulatory framework

The FMR categorises funds into three types:

- Venture capital funds (VCFs): Focus on investing in unlisted securities of start-ups and early-stage companies

- Retail funds: Can pool investments from the public and can be structured as companies or trusts

- Non-retail funds: Designed for a select group of investors, including NRI families, and can be set up as companies, LLPs or trusts

Non-retail funds

Non-retail funds are the more prevalent fund structures, relevant for close groups of investors including NRI families. Non-retail funds can be set up as a company, limited liability partnership (LLP) or trust, with the option to be open-ended, close-ended or hybrid. They can also be categorised as Category I, II, or III alternative investment funds (AIFs) depending on their investment strategy.

Non-retail funds have a minimum tenure of one year, extendable by two years. The minimum corpus requirements for non-retail funds start at US$3 million, with open-ended schemes provided the option to achieve a minimum corpus of US$3 million within 12 months.

The regulatory framework for non-retail funds includes requirements for the appointment of custodians, statutory fees, and a certain level of qualifications and experience of key managerial personnel (KMP). Non-retail funds must also comply with specific guidelines for leveraging and net asset value (NAV) computation.

Additionally, there are certain investment concentration limits that are applicable to non-retail funds. Open-ended non-retail funds cannot invest more than 25% of corpus in securities of unlisted companies. Also, no more than one third (33.33%) of the corpus can be invested in an investee company and its associates where more than 10% of the non-retail fund is held by the fund management entity (FME) or its associate.

Beyond the AIF structures in IFSC, the FMR also provide a regulatory framework for family investment funds (FIFs).

Family investment funds (FIFs)

FIFs in GIFT IFSC can be set up by members of a single family. This includes entities such as sole proprietorship firms, partnership firms, companies, LLPs, trusts or corporate bodies where a single family exercises control and holds at least 90% economic interest.

FIFs can establish additional investment vehicles after filing the necessary documents with the IFSCA. These funds or vehicles can be categorised as Category I, II, or III AIFs depending on their investment strategy. FIFs do not require a separate FME, but they must have office space and a principal officer. However, as per the amended FMR, a FIF can now choose to have a FME. If an FME is set up, it must also have KMP with prescribed qualifications and experience.

The minimum investment required for FIFs is US$10 million within three years. There are no specified minimum investor contributions or net worth requirements for the FME. FIFs can invest in both listed and unlisted securities, and there are no investment concentration limits.

Recent developments and SEBI relaxations

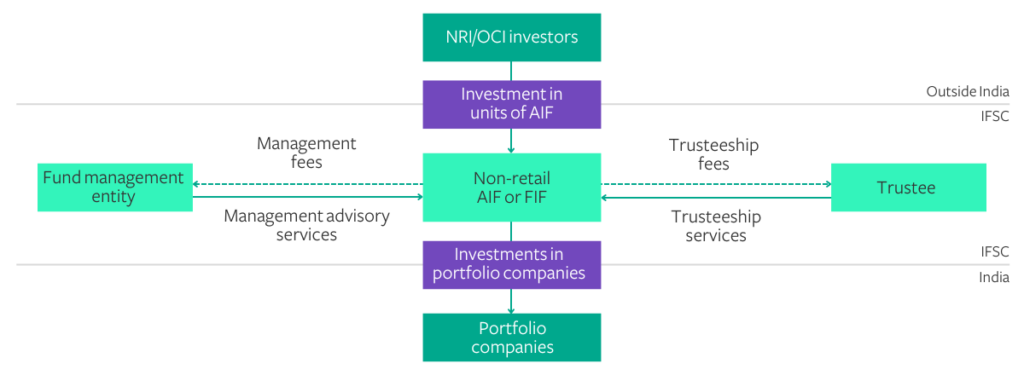

NRI families can access the Indian capital markets through the GIFT City by either setting up a non-retail AIF or a FIF structure. Either of these structures would require registration with IFSCA. In addition, in cases where the non-retail AIF or FIF would be investing in the Indian capital markets (such as listed securities, derivatives or debt instruments), it would also require registration with the Securities and Exchange Board of India (SEBI) as a foreign portfolio investor (FPI), either Category I or II.

Given the above context, one of the most significant changes made last year is the allowance for 100% contribution by NRIs/OCIs in the corpus of FPIs that are regulated by IFSCA. This marks a substantial shift from the previous restrictions where the aggregate contribution of NRIs/OCIs was limited to 50%. This liberalisation is expected to channel more NRI/OCI investments into India, providing a regulated and optimal avenue for investment through professionally managed overseas pooled structures.

Alternative investment funds vs family investment funds in GIFT City

Figure: A typical GIFT City structure

IFSCA’s introduction through the FMR of an investment concentration limit of 33.33% in a single investee company poses challenges for family office structures, potentially driving a shift from non-retail AIFs to FIFs.

Notably, FIFs have not had a dedicated beneficial tax framework as is applicable to non-retail AIF Category IIIs, which benefit from certain tax exemptions or lower tax rates. The new FMR clarify that FIFs will be construed as AIF Category I/II/III based on their investment strategy, but it remains to be seen if FIFs classified as AIF Category III will qualify for the same tax benefits. The approval letter from IFSCA will be key.

Conclusion

The evolving regulatory landscape at GIFT City, particularly with the introduction of FIFs and the liberalisation of investment contributions, presents exciting opportunities for NRIs and OCIs. These changes promise to enhance flexibility and appeal in investment options while ensuring robust regulatory oversight. Stakeholders are encouraged to stay informed and agile to leverage these opportunities effectively.

How can we help?

If you’re an NRI or OCI looking to explore investment opportunities in India, consider the advantages offered by GIFT City. Get in touch with us to understand how you can optimise your investment strategy in this dynamic environment.

About the authors

Vishal Lohia is an Associate Partner in Dhruva Advisors based in the Mumbai office. He is a chartered accountant with over 14 years of experience in tax and regulatory matters. He specialises in tax and regulatory matters pertaining to financial services, the private equity sector and family offices. Prior to joining Dhruva, Vishal was part of the financial services team at EY. Vishal’s areas of expertise more specifically include advising on regulations issued by the Reserve Bank of India (RBI), SEBI and GIFT City. In particular, he advises AIFs, non-banking financial companies (NBFCs), funds, FPIs, AIFs, banks, family offices and promoters on tax and regulatory aspects.

Khushboo Chopra has almost 20 years of experience in the Indian private and alternative capital markets. She brings a wealth of expertise and regional experience in the alternative fund space. She is knowledgeable of the nuances of AIFs and well connected with industry peers across India. At IQ-EQ, Khushboo focuses actively on developing the fund administration business in India by growing new client relationships and identifying commercial collaboration opportunities to and from India, a key market for IQ-EQ globally.