By Mansi Vora, Associate Manager, Investor Services, IQ-EQ; Nandini Pathak, Partner, Bombay Law Chambers; and Vaidehi Balvally, Associate, Bombay Law Chambers

In this special joint article, we share the key regulatory developments from 2024 for funds in the GIFT IFSC in India.

This article captures changes introduced in the calendar year 2024 to the IFSCA (Fund Management) Regulations, 2022, which have been superseded by the IFSCA (Fund Management) Regulations, 2025, with effect from 19 February 2025. The circulars listed below apply mutatis mutandis to IFSCA (Fund Management) Regulations, 2025. References to the provisions of IFSCA (Fund Management) Regulations, 2022 in this article shall have implied reference to the corresponding provisions of IFSCA (Fund Management) Regulations, 2025.

Accredited investors in GIFT IFSC

Maintenance of net worth by the fund management entity

Clarifications in relation to FMEs and schemes set up in GIFT IFSC by sovereign wealth funds

Ease of doing business – filing of schemes or funds under IFSCA (Fund Management) Regulations, 2022

Facilitating investments by non-resident Indians and overseas citizens of India into Indian securities through schemes or funds in an IFSC

Scheme asset valuations by credit rating agencies

Clarifications in relation to investment restrictions on retail schemes set up in GIFT IFSC

Complaint handling and grievance redressal by regulated entities in the GIFT IFSC

IFSCA (Informal Guidance) Scheme, 2024

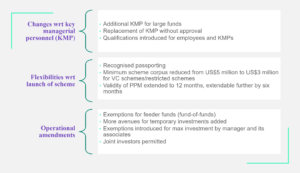

Below are some changes to the legal framework of fund management in GIFT IFSC with the notification of the IFSCA (Fund Management) Regulations, 2025.

Want expert help navigating the GIFT IFSC regulatory landscape? Get in touch with our team to learn how IQ-EQ can support your GIFT City strategy in India.

About the author

Mansi Vora is a qualified company secretary and leads compliance and investor services at IQ-EQ’s GIFT City office. She is experienced in assisting fund management entities and alternative investment funds with end-to-end support, from the entity set-up process and documentation for obtaining a regulatory license, investor onboarding and AML/KYC checks to ongoing co-sec and regulatory compliance services. She regularly liaises with regulators and authorities like the International Financial Services Centres (IFSCA), Registrar of Companies (ROC) and Special Economic Zones (SEZ) and provides an extensive range of services.

About the authors at Bombay Law Chambers

Nandini Pathak is a Partner at Bombay Law Chambers. She is an investment funds lawyer with a keen focus on setting up venture capital and private equity funds. She has over a decade of experience in the funds and asset management space, advising both international and domestic clients on legal and regulatory matters pertaining to the entire lifecycle of funds including formation, capital raising, governance, operations / compliance and liquidation. Her expertise and clientele span the alternatives space, including guiding general partners (GPs) and limited partners (LPs), intermediaries, foreign portfolio investors, investment advisers, portfolio managers and research analysts. Nandini is well known for carefully balancing LP-GP interest as well as dealing with regulators and intermediaries.

Vaidehi Balvally is an Associate at Bombay Law Chambers. She has assisted funds across their lifecycle from structuring, formation and documentation to liquidation and dissolution. She regularly liaises with regulators in India and GIFT IFSC. Her work on onshore and offshore fund structures, with asset and wealth managers, investment advisors, foreign portfolio investors and other capital market intermediaries, enables her to offer a wide variety of services as a legal professional.